HOW ARE HEALTH INSURANCE PREMIUMS DETERMINED IN THE USA?

A visual essay to investigate various variables affecting the determination of individual costs of health insurance in the USA.

“Health insurance is a type of insurance that covers medical expenses that arise due to an illness. These expenses could be related to hospitalization costs, cost of medicines or doctor consultation fees”2. Insurance companies might decide upon a monthly premium by looking at the risk of medical care and expected medical expenses. These days health insurance is considered a necessity by many as it helps getting timely treatment and reduces the over all burden of diseases on a person’s life4.

The importance of health insurance has led to the entry of many government and private insurance companies in the market. However, the question of how insurance companies decide how much to charge an individual remains unclear as different characteristics of each individual might be affecting that decision.

In this article we aim to present a quantitative and comprehensive investigation of different characteristics of insurance members in the United States of America and how those characteristics might be affecting their amounts of premiums.

THE DEMOGRAPHICS OF INSURANCE MEMBERS

Age - Gender - Region - Children

1. Higher Frequency of Younger Age-group

The following visualization shows that the frequency of 15- and 20-year-olds is higher among the people who registered for health insurance in USA as only for them the population is above 165 whereas the population for the rest of insurance members remains below 150. Why might this be?

The reason for this could be that as the teenagers are more prone to high-risk behavior, they may end up using that insurance more often5. However, this contradicts the more widely accepted argument of high rate of uninsured 18–20-year-olds in the US6 due to high medical costs and their lack of literacy on insurance10.

3. Equal Distribution Across Regions

The number of people insurance members are almost equal in all four regions. However, it can be noticed that insurance members from the Southeast region are slightly higher in number.

2. Equal Gender Ratio

The sex composition of insurance members of USA is shown using a pie chart which highlights that the ratio of females is only 1% less than males. The difference is insignificant and has been since 19841.

The negligible difference might be due to non-existing disparity in household resource allocation in the US as both men and women tend to work. Whereas if we had looked into the sex composition of insurance members in South Asia, we would have observed less ration of females due to women not being able to pay for their health insurance7.

4. Dependents of Insurance Members

The number of people who register for health insurance is highly influenced by the number of children they have. The less children an individual has the more likely he/she is to register for medical insurance. This could be due to the already higher expenses of parents with more children which does not allow them to spend a large amount on insurance payment.

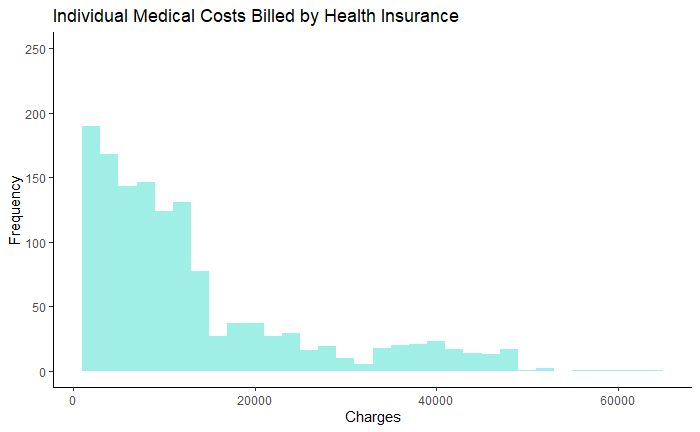

PREMIUMS OF INSURANCE MEMBERS

Looking at the individual medical costs billed by insurance companies we can see that they are positively skewed which means that the majority of people have premiums/charges less than 15000 and as the charges increase, the number of insurance members decreases. This relationship might exist because people with characteristics or less probable health risk which might increase premium rates for them, tend to not get health insurance. And people might think that the increase in the insurance charges is not worth it when the probability of getting the disease is very small. An example of this thought process is shown by smokers which we explore in the next part.

SMOKERS, BMI, AND INSURANCE PREMIUMS

1. Smoking and Insurance Premiums

The comparison of smoker versus non-smoker insurance members clearly shows that the number of smokers who registered for health insurance is almost 4 times less than that of non-smokers. What might be the reason for this significant difference?

So far, the article has discussed individual demographic factors of insurance members but now we look into their smoking habits as those might play an important role in predicting their future health and in turn their expected medical costs. So, many insurance companies also use smoking habits as a factor in deciding insurance premiums. The Affordable Care Act of 2010 allows insurance companies to charge smokers 1.5 times higher premiums - This is called tobacco rating. Considering the high cost, many smokers decide to forgo getting insurance3.

2. Smokers and BMI

The argument for tobacco rating becomes more convincing when you look at the relationship between people’s smoking habits and their BMIs. The negative association of smokers and their BMIs is obvious from the fact that the average BMI of smokers is less than that of non-smokers. Moreover, the BMI of smokers is more varied than that of non-smokers.

An experiment done by Piirtola, et al. checked the effect of smoking on BMI by using twin pairs to control for family background and the results are consistent with ours as “smoking is associated with lower BMI"8.

As insurance companies do look into individual BMIs, they tend to charge higher from smokers who are more susceptible to diseases due to lower BMIs3.

FACTORS AFFECTING INSURANCE CHARGES

Now, that we have discussed in detail the different factors potentially affecting insurance charges, we are going to look at the correlations of different factors with insurance charges to see if they actually do influence individual insurance charges.

However, as we observed that the gender composition and distribution of insurance members across regions was almost equal, they could not have affected their insurance charges. Moreover, we have already seen the negative relationship So, we are going to look at the relationship of age, smoking habits, BMI, and number of children with insurance charges across regions.

1. Age and Insurance Charges

The correlation here shows that as age of insurance members increases, their insurance charges also increase.

3. BMI and Insurance Charges

Higher BMIs are also associated with higher risk of diseases, which eventually leads to higher individual insurance charges. This positive correlation can be observed in the above visualization.

2. Smoker and Insurance Charges

There seems to be a very strong correlation between smoking habits and insurance charges across all regions

4. Children and Insurance Charges

Having any number of children seems to have the same association with insurance charges. However, insurance charges are lower for people with no children.

Now that we have observed the relationships of different factors with insurance charges, we want to check if they establish a cause and effect pattern and for that purpose we did the a regression analysis as shown by the visualization.

Looking at the table, we can see that all four factors have positive coefficients which are statistically significant. This essentially means that as an individual's age, BMI, number of children increase or if a that person smokes, the amount insurance companies charges them increases.

The significantly larger coefficient of smoking highlights the fact that it has the most impact on insurance charges, This implies that a non-smoker pays notably less than a smoker in health insurance charges. Lastly, the results of our regression analysis comply with our earlier observations.

WHO BENEFITS FROM THESE FINDINGS?

Both the insurer and the insured can benefit from this information. The insurance companies can use this information to calculate the risk of having to pay for each individual and how much they might have to pay in medical cost depending on that person’s health and several other characteristics. Depending on that risk, those insurance companies can decide on an amount of premium for each individual. In short, this visual essay provides suggestions for the insurance companies to make insurance policies appropriate for individuals based on their characteristics. Moreover, it can guide individuals looking to get insurance towards insurance companies with insurance policies suitable and affordable for them based on their incomes and different characteristics.

Citations:

1. “Private Health Insurance Share by Gender U.S. 1984-2019.” Statista, 8 Sept. 2021, https://www.statista.com/statistics/188323/persons-in-the-us-with-private-health-insurance-by-gender-since-1984/.

2. “What Is Health Insurance - Health Insurance Meaning & Definition: ICICI Prulife.” Icici Prudential Life Insurance, https://www.iciciprulife.com/health-insurance/what-is-health-insurance.html.

3. “What You Need to Know about Smoking and Health Insurance.” HealthMarkets, 2012, https://www.healthmarkets.com/content/smoking-and-health-insurance.

4. Bovbjerg, Randall R., and Hadley, Jack. “Why Health Insurance Is Important .” Urban Institute, 9 Nov. 2007, pp. 1–3., https://doi.org/https://www.urban.org/sites/default/files/publication/46826/411569-Why-Health-Insurance-Is-Important.PDF.

5. Brennan, Rachael. “The Best Cheap Car Insurance and Average Costs for 18-Year-Olds.” MoneyGeek.com, MoneyGeek.com, 2 Dec. 2021, https://www.moneygeek.com/insurance/auto/best-cheap-car-insurance-for-18-year-olds/#:~:text=Because%20they%20have%20little%20or,higher%20than%20any%20other%20category.&text=There%20are%20several%20strategies%20parents,for%20their%20newly%20licensed%20drivers.

6. Cantiello, John, et al. “The Impact of Demographic and Perceptual Variables on a Young Adult’s Decision to Be Covered by Private Health Insurance.” BMC Health Services Research, vol. 15, no. 1, 2015, https://doi.org/10.1186/s12913-015-0848-6.

7. Jain, Radhika. 2019–2022 Asia Health Policy Postdoctoral Fellow. “Women Left behind: Gender Disparities in Health Insurance Utilization in India.” Development Asia, 9 Nov. 2021, https://development.asia/insight/women-left-behind-gender-disparities-health-insurance-utilization-india.

8. Piirtola, Maarit, et al. “Association of Current and Former Smoking with Body Mass Index: A Study of Smoking Discordant Twin Pairs from 21 Twin Cohorts.” PLOS ONE, vol. 13, no. 7, 2018, https://doi.org/10.1371/journal.pone.0200140.

9. Schwartz, Karyn. “Spotlight on Uninsured Parents: How a Lack of Coverage Affects Parents and Their Families.” Kaiser Low-Income Coverage and Access Survey - KFF, June 2007, https://kff.org/wp-content/uploads/2013/01/7662.pdf.

10. Yang, Lawrence H.. “Assessing Young Adults' Attitudes and Perceptions on Health Insurance and their Health Insurance Literacy Levels.” (2016).